Executive Summary

The debate is over. As we enter 2026, AI has moved from speculative potential to operational reality across investment management. The firms that treated 2025 as a sprint now face a different challenge: scaling what works while governing what could go wrong.

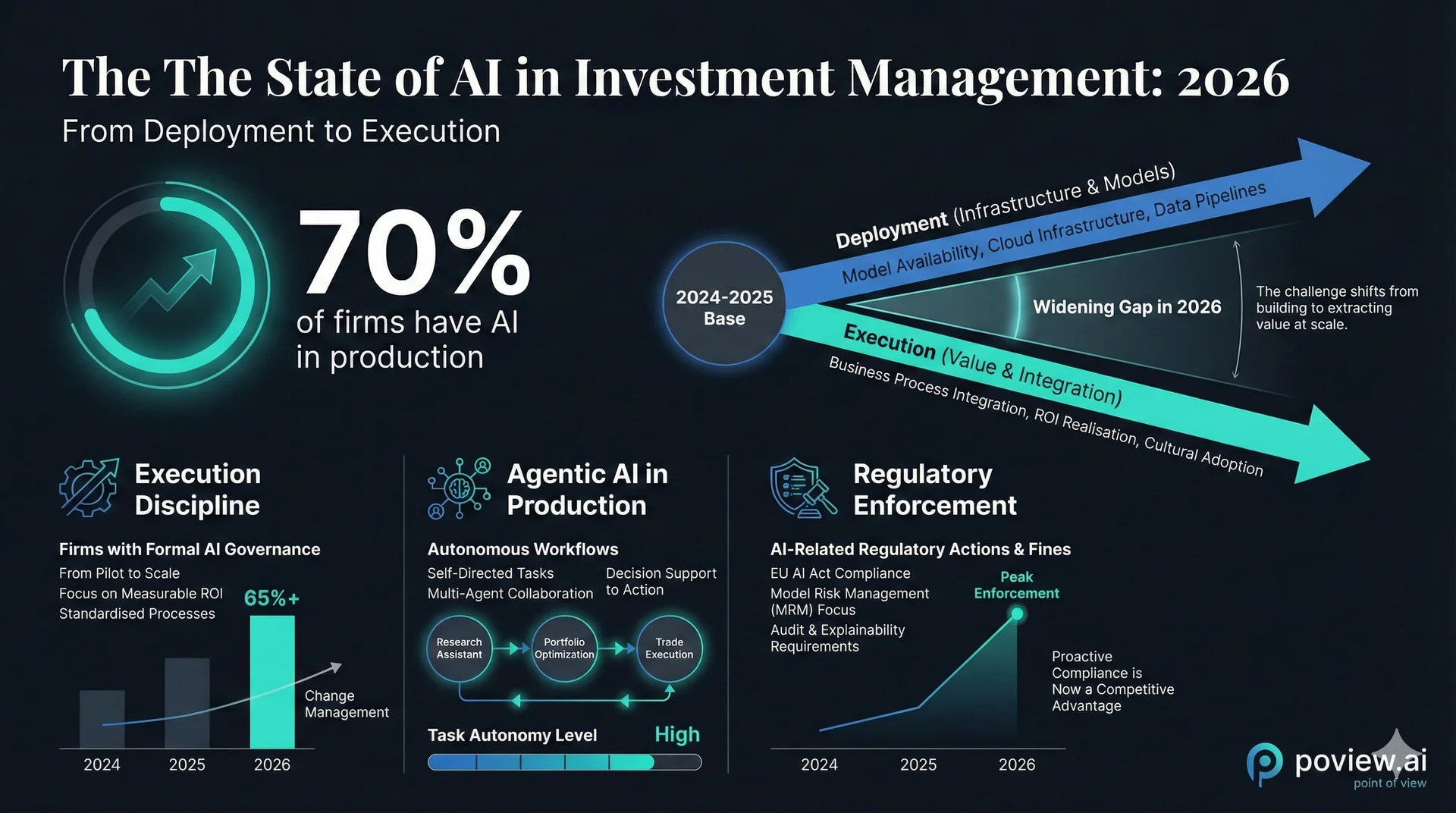

The numbers tell the story. Around 30% of asset managers reported scaled AI use in 2023. By the close of 2025, that figure exceeded 70% (NVIDIA State of AI in Financial Services, February 2025; EY Financial Services Regulatory Outlook, 2026). The shift from experimentation to infrastructure happened faster than most predicted, and the gap between leaders and laggards is now measured in competitive years, not quarters.

What makes 2026 different? Three forces are converging. Agentic AI is moving from pilots into production. Regulators are shifting from guidance to enforcement. And the governance gap, the industry's open secret, is becoming impossible to ignore. The firms that navigate all three will define the next decade. Those that don't may not survive it.

Author's note: I use AI-powered tools responsibly for research, brainstorming, and editing. They accelerate exploration, but the analysis and conclusions remain my own.

The Scale of AI Adoption: Where We Stand

The data is no longer ambiguous. AI is embedded across core investment management workflows, and the benefits are measurable.

NVIDIA's 2025 State of AI in Financial Services survey, based on responses from approximately 600 global financial services professionals, found that nearly 70% of firms reported AI-driven revenue increases of 5% or more, with a growing cohort seeing gains in the 10-20% range. Over 60% reported annual cost reductions of at least 5%. Half of management respondents have deployed generative AI services in production, with an additional 28% planning to do so within six months (NVIDIA, February 2025).

This momentum exists against difficult margin conditions. Global AUM reached $147 trillion by mid-2025, yet pre-tax operating margins declined materially between 2019 and 2023, particularly in Europe (McKinsey Global Asset Management Report, 2024). Technology spend has increased, but productivity gains have lagged. AI is being evaluated as a structural response to that imbalance.

McKinsey's analysis suggests AI could reduce an asset manager's cost base by 25-40% when deployed end-to-end. These gains do not come from isolated tools, but from reimagining workflows across investment, distribution, compliance, and technology.

Generative AI adoption has accelerated notably. According to NVIDIA's survey, 52% of financial services professionals now leverage generative AI tools, up from 40% in 2024. The use of generative AI for customer experience, particularly via chatbots and virtual assistants, has more than doubled, rising from 25% to 60% (NVIDIA, February 2025).

Where AI Is Delivering: Real Use Cases, Measurable Results

Adoption remains uneven, but a clear pattern has emerged: AI moves fastest where it directly impacts revenue, client experience, or scale constraints.

Client acquisition and retention lead the charge. Morgan Stanley's AI assistant reached 98% adoption among advisor teams, dramatically improving document retrieval, meeting summarisation, and response times (Morgan Stanley communications, 2024). Goldman Sachs reports around 10,000 employees now use its GS AI Assistant for summarising and analysis (Goldman Sachs, June 2025). AI-supported workflows have been cited as contributors to record net new asset flows.

Investment processes are evolving. Firms such as Two Sigma, Citadel, Millennium, and Bridgewater have embedded AI into portfolio construction, simulation, and risk management. The goal is not replacing judgement, but expanding coverage, consistency, and speed. AI augments analysts; it does not eliminate them. Notably, Schroders Capital expanded its AI toolkit with a virtual "investment committee agent" designed to support decision-making processes (Schroders Capital, June 2025).

Operations and compliance represent another frontier. UK Finance reports Tier 1 institutions cutting compliance reporting time by up to 60% using generative AI support (UK Finance, Generative AI in Action, 2025). JPMorgan's COiN platform processes tens of thousands of contracts in seconds, work that previously consumed hundreds of thousands of human hours annually.

The top generative AI use cases by return on investment are trading and portfolio optimisation at 25%, followed by customer experience and engagement at 21% (NVIDIA, February 2025).

AI-Focused Products and Capital Flows

Capital flows tell a compelling story. Assets in AI and big data funds have grown more than sevenfold in five years, reaching over $38 billion by early 2025. Europe accounts for nearly two-thirds of global AI fund assets, while US-domiciled AI funds have expanded fourteenfold in just two years.

Major asset managers have launched AI-focused ETFs and active strategies. Sovereign-backed vehicles such as Abu Dhabi's MGX are targeting up to $100 billion in AI infrastructure investment. Venture capital investment in AI exceeded $100 billion globally in 2024, with generative AI alone attracting roughly $45 billion.

According to Oliver Wyman's 2026 predictions, tokenized real-world assets will finally cross the $100 billion barrier in 2026, up from roughly $37 billion at year-end 2025 (Oliver Wyman, December 2025). The convergence of AI and tokenization is creating new product categories that would have been impossible even two years ago.

The signal is clear: capital markets are treating AI as long-duration infrastructure, not a cyclical technology trade.

Governance: The Industry's Largest Gap

Ask a straightforward question in most boardrooms: Which AI systems are making decisions that affect clients today?

Few organisations can answer it cleanly.

The gap between deployment and understanding is widening. While over 70% of banks report using agentic AI in some form, governance frameworks are disturbingly lacking (EY Financial Services Regulatory Outlook, 2026). Only a minority of firms report full visibility into how their AI systems operate, who owns them, and how risks are managed.

This gap creates exposure. AI systems evolve continuously. Third-party dependencies are growing. Point-in-time risk assessments are no longer sufficient, yet many governance models still assume they are.

The Bank of England's 2024 AI report revealed that while 75% of UK financial firms use AI and 81% employ some kind of explainability method, only 34% report having "complete understanding" of their AI technologies, with 46% admitting to only "partial understanding" (Bank of England, November 2024). The challenge isn't the absence of explainability methods, but their adequacy for meeting evolving regulatory requirements.

Effective AI governance requires five capabilities that most firms have not fully built:

- A complete inventory of AI systems

- Risk-based controls proportionate to impact

- Continuous monitoring for drift and bias

- Cross-functional ownership bridging technology and business

- Robust third-party risk management

Most firms can describe these on a slide. Far fewer can demonstrate where they actually live.

What Distinguishes Leaders from Laggards

A November 2025 study commissioned by Microsoft found that "Frontier Firms", organisations that embed AI agents across every workflow, report returns on their AI investments roughly three times higher than slow adopters (IDC/Microsoft, November 2025). The difference is not access to technology. It is execution discipline, governance maturity, and architectural foundations.

The firms pulling ahead share common traits. They treat AI as core infrastructure, invest against business outcomes, and commit to multi-year programmes rather than opportunistic pilots. They balance central governance with decentralised experimentation. They modernise core platforms, accelerate delivery cycles, and retrain both technical and non-technical talent to work effectively with AI systems.

Leading firms also take a different approach to vendor management. When critical AI capabilities come from external providers, governance extends beyond internal controls to vendor oversight. This includes access to model documentation, performance monitoring data, and validation of vendor claims about system capabilities.

The laggards delay. And delay compounds. Returns on AI investment typically materialise over 12-24 months. Waiting simply gives competitors time to entrench advantage.

Agentic AI: The Next Frontier

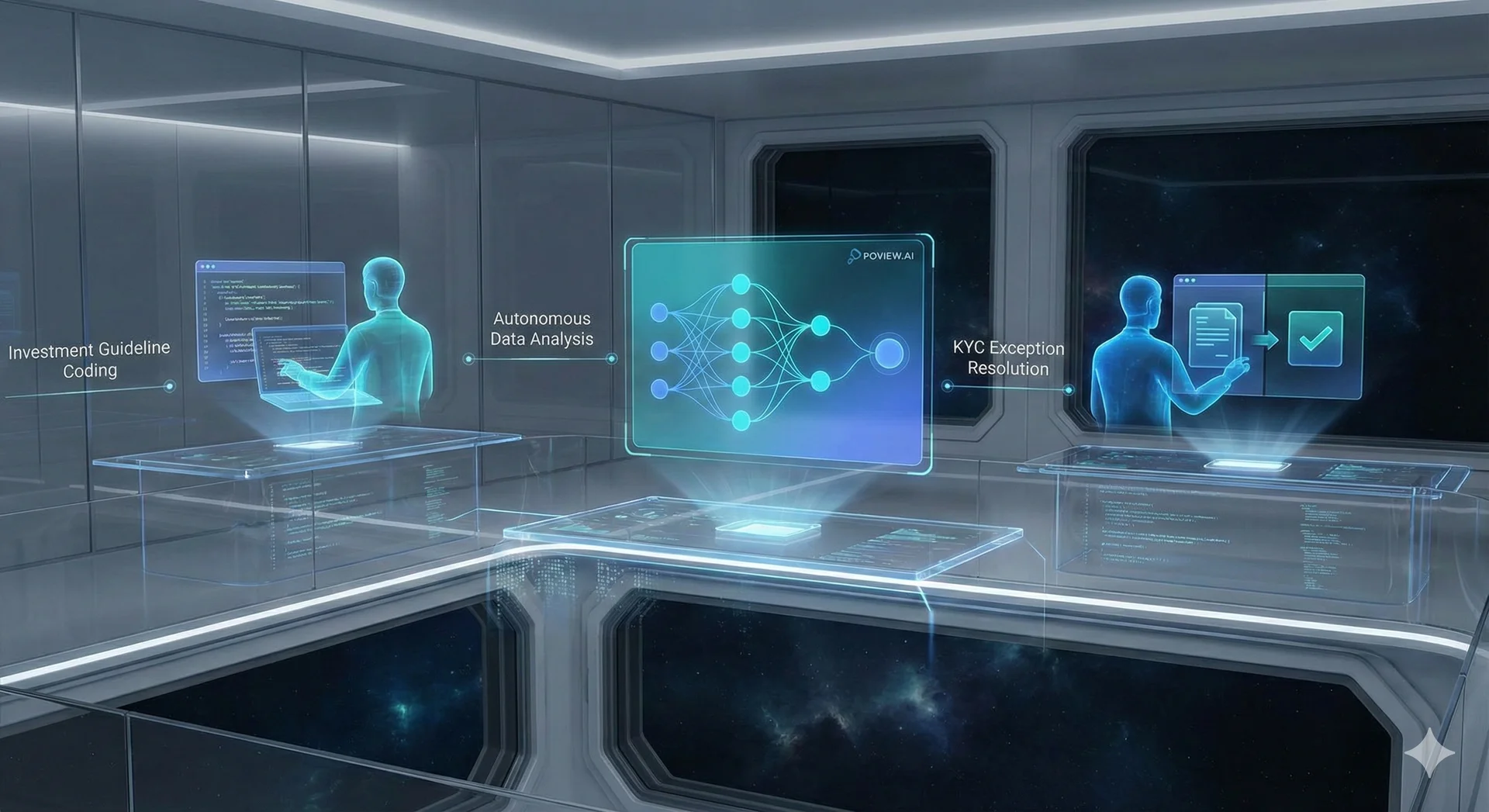

The next phase is agentic AI: systems that can plan, act, and coordinate across other systems without continuous human instruction. McKinsey and Accenture predict that by 2026, more than 70% of financial institutions will deploy agentic and autonomous AI decisioning tools, though under strict governance frameworks (Deloitte Regulatory Outlook, 2026).

Use cases already in production or advanced pilot include automated guideline coding, KYC exception resolution, dynamic risk modelling, and multi-step compliance workflows. OpenText's Head of Financial Services predicts that AI will become deeply embedded in core financial operations in 2026, "acting as a trusted teammate that predicts risk, automates compliance, and adapts to customer needs in real time" (OpenText, December 2025).

Insight Partners forecasts that the industry will approach "million-agent problems" and systems that can complete a full day's work autonomously. Managing Director Ganesh Bell predicts "a new computing fabric will emerge to manage more Agents at work than humans" (Insight Partners, December 2025).

The governance challenge is acute. Traditional model-risk frameworks assume static, well-specified algorithms and one-time validations. Large language models and multi-agent systems violate those assumptions by learning continuously, exchanging latent signals, and exhibiting emergent behaviour.

The strategic tension is clear: move too fast and risk regulatory blowback; move too slowly and cede ground.

2026 Predictions: Three Scenarios

What follows are forward-looking assessments across three scenarios: conservative, base case, and ambitious. These are extrapolated from research and should be understood as illustrative projections, not forecasts.

Conservative Scenario: Consolidation and Caution

In a more cautious trajectory, 2026 becomes a year of consolidation rather than acceleration.

Governance frameworks mature, adoption plateaus. The EU AI Act's August 2026 deadline for high-risk system compliance creates friction. Firms prioritise remediation over new deployments. McKinsey's projected 25-40% cost reductions prove achievable only for tier-one institutions with existing governance infrastructure.

Agentic AI remains in controlled pilots. Despite vendor enthusiasm, most firms restrict agentic systems to low-risk, back-office functions. Human-in-the-loop requirements remain the norm. Regulatory uncertainty, particularly in the US, slows enterprise-wide rollout.

M&A accelerates in AI-adjacent sectors. Insight Partners predicts a "reckoning" among subscale AI security startups, many of which get acquired for IP rather than traction. Platform incumbents consolidate advantage.

Private market tokenization grows modestly. Oliver Wyman's $100 billion threshold proves optimistic; actual growth lands closer to $60-70 billion as regulatory clarity lags in key jurisdictions.

Base Case: Execution Year

The base case sees 2026 as the year execution discipline separates sustainable leaders from the field.

Agentic AI moves into production at scale. Forrester predicts over half of under-50 consumers seeking financial advice will turn to generative AI tools, forcing firms to deploy AI-driven advisory services within strict risk limits (Forrester, 2026). Tier-one banks move beyond pilots, with nearly half deploying AI agents for back-office automation including data reconciliation and code generation.

Governance becomes competitive advantage. Compliance shifts from cost centre to differentiator. Firms that built governance infrastructure in 2024-25 deploy new capabilities faster. Those that deferred face costly retrofits and extended implementation timelines.

Regulatory enforcement begins in earnest. The EU AI Act's high-risk provisions take effect. DORA's operational resilience mandates bite. EY's regulatory outlook projects 20-30% year-over-year increases in compliance workload for AML, fraud monitoring, and data privacy. Real-time monitoring becomes standard; batch reporting becomes inadequate.

AI ROI becomes measurable and expected. NVIDIA's finding that 70% of firms see 5%+ revenue gains becomes table stakes. Boards demand clear attribution. Firms unable to demonstrate ROI face budget scrutiny.

Hyper-personalisation arrives. AI-enabled one-to-one messaging moves from aspiration to deployment. Celent forecasts that 18% of all e-commerce in Europe will be agent-initiated by 2035; the foundation for that shift is laid in 2026.

Ambitious Scenario: Acceleration and Disruption

In a more aggressive trajectory, 2026 marks a step-change in industry structure.

Million-agent orchestration becomes reality. Insight Partners predicts the first "million-agent problem" will be introduced and solved within 18 months from late 2025. If achieved, this enables coordinated AI workforces that fundamentally change how investment research, compliance monitoring, and client service operate.

AI-native payments emerge. Major card networks roll out standardised frameworks for AI-driven transactions, enabling "agentic commerce" where AI agents initiate and execute financial transactions on behalf of clients. Visa and Mastercard standardise verification protocols for agent-to-agent transactions.

Governance automation scales. PwC predicts 2026 as the year companies roll out repeatable, rigorous responsible AI practices. Automated red-teaming, AI-enabled inventory management, and continuous assessment become operational rather than aspirational.

Digital assets cross into mainstream allocation. Tokenized funds proliferate following US stablecoin regulatory clarity (GENIUS Act). Multiple major US asset managers launch tokenized money market funds. Round-the-clock trading becomes available for traditional asset classes.

Talent market inverts. Demand shifts from "AI specialists" to "AI orchestrators", professionals who can coordinate AI agent teams and design workflows. Engineers become system designers rather than code writers. The firms that anticipated this shift gain decisive talent advantage.

What 2026 Demands

Regardless of which scenario materialises, several imperatives are clear.

Build governance before you need it. Retrofitting controls onto deployed systems is expensive and slow. The firms that invested in governance infrastructure during 2024-25 will deploy new capabilities faster than those scrambling to catch up.

Prepare for regulatory enforcement. The EU AI Act's August 2026 deadlines are not negotiable. DORA's operational resilience mandates have teeth. Firms that treated these as compliance exercises rather than strategic investments face costly remediation.

Treat AI as infrastructure, not innovation. The distinction matters. Innovation can be deferred. Infrastructure cannot. Boards that still view AI through an R&D lens will find themselves explaining margin erosion that competitors avoid.

Invest in talent that bridges. The scarcest capability in 2026 will be professionals who understand both AI technology and financial services operations. Firms that build or acquire this talent will execute faster and make fewer expensive mistakes.

Accept that the gap is widening. The competitive distance between leaders and laggards is no longer narrowing. Every month of delay adds to governance debt that becomes more expensive to address. The window for catching up is closing.

Final Thought

The debate for boards is no longer whether to invest in AI. It is how fast, how governed, and how tightly integrated with business strategy those investments should be.

The next 12-18 months will determine competitive positioning for years to come. The firms that balance speed with control, ambition with governance, will define the industry's next chapter.

Those that don't will become case studies in what happens when structural change meets institutional inertia.

Sources Referenced

TIER 1 (Primary Sources):

- NVIDIA. "State of AI in Financial Services: 2025 Trends." February 2025. Survey of approximately 600 global financial services professionals.

- Bank of England and Financial Conduct Authority. "Artificial Intelligence in UK Financial Services 2024." November 2024.

- UK Finance. "Generative AI in Action: Opportunities & Risk Management in Financial Services." 2025.

- Morgan Stanley. Press releases and investor communications. 2024.

- Goldman Sachs. Internal communications and public statements. June 2025.

TIER 2 (Secondary with Attribution):

- Oliver Wyman. "10 Asset Management Trends to Know in 2026." December 2025.

- Deloitte. "2026 Investment Management Outlook." November 2025.

- McKinsey Global Institute. "The Economic Potential of Generative AI." 2023.

- IDC/Microsoft. "Frontier Firms AI Investment Study." November 2025.

- EY. "Financial Services Regulatory Outlook 2025-2026." 2025.

TIER 3 (Methodologically Limited):

- Insight Partners. "Five Major Trends Reshaping AI, Software, and Leadership: Our Investor Predictions for 2026." December 2025.

- PwC. "2026 AI Business Predictions." December 2025.

- Forrester. 2026 Financial Services Predictions.

- Schroders Capital. Press release regarding AI investment committee agent. June 2025.

- OpenText. Industry predictions from Head of Financial Services Industry Strategy. December 2025.

About the Author: Terry Yodaiken advises financial institutions on AI governance and operational transformation. He works with COOs across £2 trillion in assets and has led technology implementations across 15+ jurisdictions. His firm, POVIEW.AI, helps institutions bridge the gap between AI capability and practical governance.

If you want a clear, practical view of where your organisation stands, and what needs to change, let's talk.

POVIEW.AI helps organizations implement governed, measurable AI solutions that deliver real business value.